All Categories

Featured

There is no one-size-fits-all when it comes to life insurance coverage. Getting your life insurance policy strategy ideal considers a variety of aspects. [video description: Pleasant music plays as Mark Zagurski speaks to the camera.] In your active life, economic self-reliance can feel like an impossible objective. And retired life may not be leading of mind, since it appears up until now away.

Fewer employers are providing traditional pension strategies and several companies have decreased or discontinued their retirement plans and your capacity to depend solely on social security is in concern. Even if benefits have not been minimized by the time you retire, social safety and security alone was never ever meant to be enough to pay for the way of living you want and are entitled to.

/ wp-end-tag > As part of an audio economic technique, an indexed global life insurance coverage policy can assist

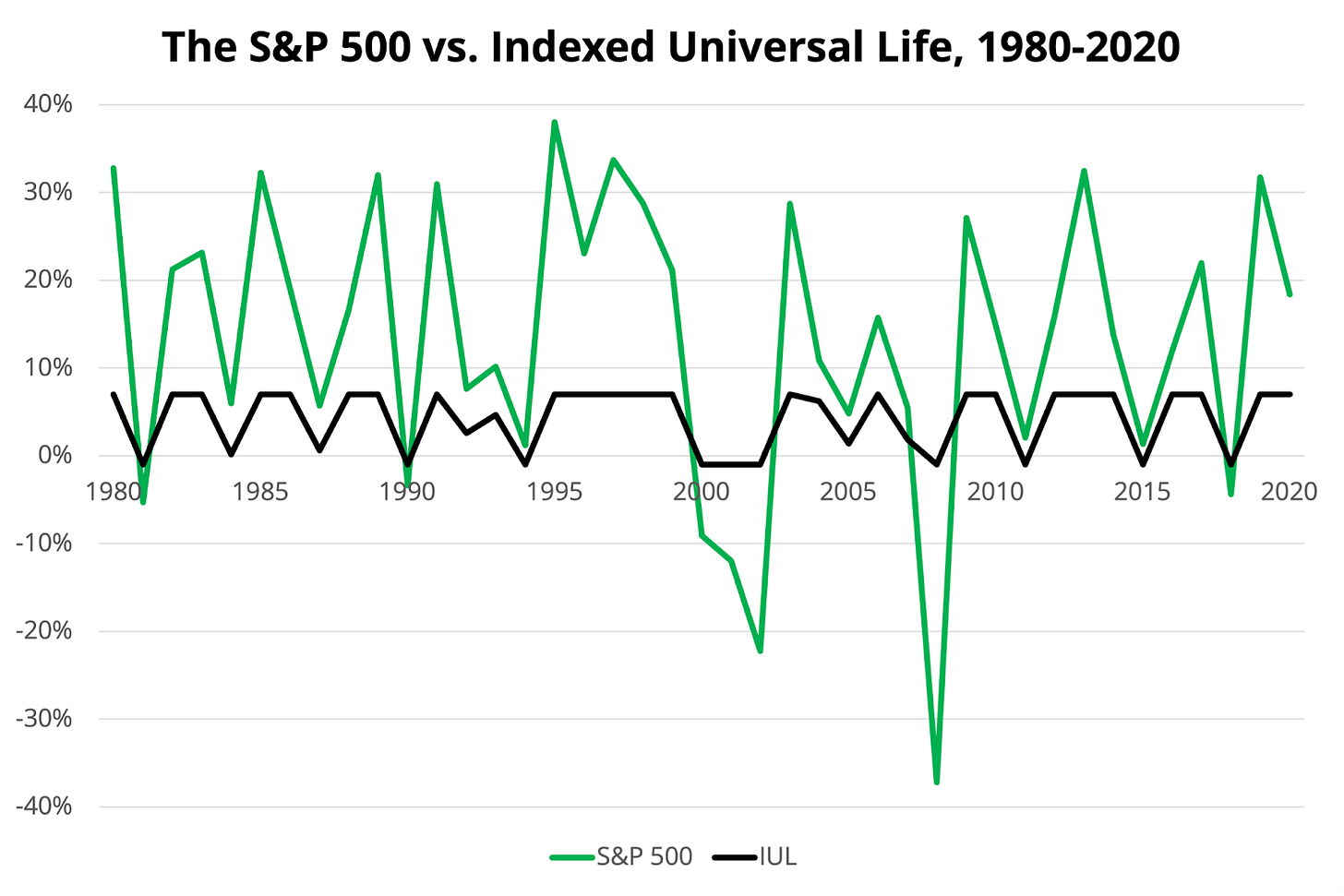

you take on whatever the future brings. Before committing to indexed global life insurance, here are some pros and cons to think about. If you pick a good indexed universal life insurance policy strategy, you might see your money value grow in worth.

Smart Universal Life Insurance

Since indexed universal life insurance needs a particular level of threat, insurance policy companies have a tendency to keep 6. This kind of strategy likewise offers.

Usually, the insurance coverage business has a vested interest in executing better than the index11. These are all elements to be thought about when selecting the ideal type of life insurance coverage for you.

Is Iul Insurance A Good Investment

Considering that this kind of plan is extra complex and has a financial investment part, it can usually come with higher costs than other policies like entire life or term life insurance coverage. If you don't assume indexed global life insurance is right for you, here are some alternatives to think about: Term life insurance is a temporary plan that commonly provides coverage for 10 to 30 years.

When deciding whether indexed universal life insurance policy is ideal for you, it is necessary to consider all your alternatives. Whole life insurance policy may be a far better selection if you are seeking more stability and consistency. On the other hand, term life insurance policy might be a better fit if you just require coverage for a specific period of time. Indexed universal life insurance policy is a kind of plan that uses a lot more control and versatility, together with higher cash worth development potential. While we do not offer indexed universal life insurance policy, we can provide you with even more information about entire and term life insurance coverage policies. We suggest exploring all your choices and talking with an Aflac representative to find the very best suitable for you and your family members.

The remainder is included to the cash money value of the plan after charges are subtracted. While IUL insurance might prove important to some, it's essential to recognize exactly how it works prior to purchasing a policy.

Latest Posts

Fixed Universal Life Insurance

Universal Life Policy Pros Cons

Indexed Universal Life Insurance Comparison