All Categories

Featured

There is no one-size-fits-all when it revives insurance policy. Getting your life insurance policy plan appropriate takes into account a variety of factors. [video description: Pleasant music plays as Mark Zagurski speaks to the camera.] In your active life, monetary independence can feel like an impossible goal. And retirement may not be top of mind, due to the fact that it appears thus far away.

Fewer employers are providing typical pension plan strategies and many business have actually reduced or terminated their retired life strategies and your capacity to count only on social security is in concern. Also if benefits haven't been decreased by the time you retire, social safety alone was never planned to be adequate to pay for the way of life you desire and should have.

/ wp-end-tag > As part of an audio financial technique, an indexed universal life insurance coverage policy can aid

you take on whatever the future brings. Before committing to indexed global life insurance coverage, below are some pros and cons to take into consideration. If you choose a great indexed universal life insurance policy plan, you might see your cash money worth grow in value.

Ffiul Insurance

If you can access it at an early stage, it may be useful to factor it right into your. Given that indexed global life insurance policy needs a particular level of threat, insurer often tend to keep 6. This kind of plan additionally provides (adjustable life plan). It is still assured, and you can change the face amount and riders over time7.

Commonly, the insurance policy company has a vested interest in executing far better than the index11. These are all factors to be thought about when selecting the finest kind of life insurance for you.

Accumulation Value Of Life Insurance

Given that this kind of plan is extra intricate and has a financial investment part, it can often come with greater premiums than other policies like whole life or term life insurance policy. If you don't assume indexed global life insurance policy is appropriate for you, right here are some alternatives to think about: Term life insurance policy is a short-lived policy that normally uses protection for 10 to thirty years.

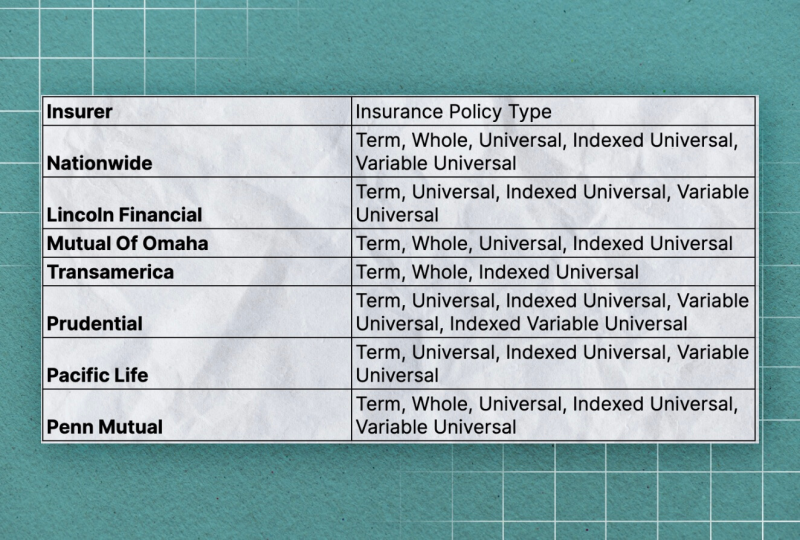

When choosing whether indexed universal life insurance policy is best for you, it is essential to take into consideration all your options. Whole life insurance policy might be a much better option if you are searching for even more stability and uniformity. On the other hand, term life insurance policy may be a much better fit if you only need protection for a particular period of time. Indexed global life insurance is a sort of plan that uses a lot more control and adaptability, in addition to higher cash worth growth potential. While we do not provide indexed global life insurance policy, we can supply you with more info concerning whole and term life insurance policy policies. We suggest checking out all your options and talking with an Aflac representative to find the most effective suitable for you and your family members.

The rest is included to the cash money worth of the plan after fees are deducted. The money worth is attributed on a monthly or yearly basis with interest based upon increases in an equity index. While IUL insurance coverage may prove beneficial to some, it is essential to recognize just how it functions before purchasing a policy.

Latest Posts

Fixed Universal Life Insurance

Universal Life Policy Pros Cons

Indexed Universal Life Insurance Comparison